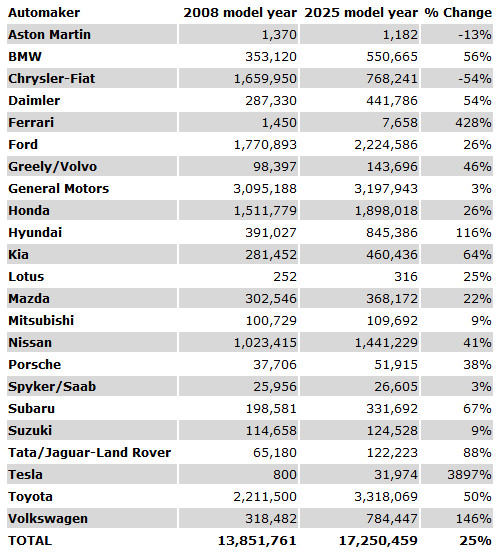

Don’t ask why, but I stumbled into this chart used in a post by my son at the other site from 2011. It showed predictions of the US market in 2025 as part of the EPA’s work in revising its proposed 2017-2015 fuel efficiency standards. These predictions were made by the DOE and the research firm CSM. It shows actual 2008 sales and predicted 2025 sales by manufacturer. Even a quick glance shows how far off they were, from a 2018 vantage point. Of course 2025 is still seven years away; anything could happen.

It made me curious as to just how far off their predictions were from 2018 sales, so I wasted 45 minutes creating a spread sheet. But in addition to debunking these estimates, it does show meaningful information on how these companies have fared over the past ten years, in absolute and relative terms:

So here’s 2008 actuals followed by market share, the 2025 predictions and market share, and then 2018 sales (based on 11 months actuals), and 2018 market share. The second to last column shows the percentage change from the 2025 predictions to 2018 actuals. And the last column is the actual change from 2008 to 2018.

So what stands out? These folks weren’t the only ones who grossly underestimated the success of FCA back in 2008, which ended up beating the 2025 projections by 191%, thanks to Jeep and a nascent Ram. The Germans (except Porsche) all were expected to perform better. The same applies to Honda, Hyundai, Mazda, and Toyota. The trajectory of all these brands slowed down from their higher growth pre-2008 upon which the projections were obviously based. The big exceptions are Subaru, which has been a stellar performer, and of course Tesla, which has already exceeded its 2025 projections by 442%. Ford did a bit better than expected, and GM did worse.

So much for the crystal ball.Well, for what it’s worth, their prediction for the total market (17.25 million) in 2025 is almost exactly the size of the current market (17.1 million). The luck of the draw.

How about reality?

The winners that outpaced the market growth of 23.5% from 2008 to 2018 are: Tesla (+21567%), Subaru (+238%), Kia (+110%), JLR (+82%), Hyundai (+71%), Porsche (+54%), Nissan (+43%), Ford (+40%), and FCA (+35%).

The big losers (other than those that left the market) are: VW Group (not including Porsche): (-8%), GM (-6%), and BMW (-2%), Mazda (-1%). But Honda, Toyota, Mercedes, Mitsubishi and Volvo are also losers too, as their single-digit growth was below the market’s 23.5% growth from 2008 to 2018.

So now I should make my own projections for 2025 and hold myself accountable in seven years hence. Hmm…

My friend Rip van Winkle Jr. just stopped by from 1950 so I showed him this list.

“Whoa, what happened while I was gone? Looks like Ford and GM did OK and Chrysler must have rescued that Italian outfit. But what are all these strange names selling so many cars? Mitsubishi made fighter planes. Toyota, Nissan and Honda sound Japanese too… now you’re buying millions of their cars?

“Hyundai, did somebody sneeze? Tesla, didn’t he used to make spark coils? Where are my beloved Packard, Hudson, Studebaker and Nash? Cars must be changing all the time in this 21st century America. I could never have predicted this.”

Wait’ll you tell him what happened to “longer-lower-wider”!

These Top Men were bullish on Suzuki!

Interesting data compile. Did they make any predictions about Daewoo? They are coming out with a large SUV made of asbestos and New Coke next year.

Mitsubishi might seem like a loser compared to the competition, but they continue to gain sales with a minimal investment in new product, so their profit margin must be healthy on each sale. It seems like a safe, conservative business model to me.

Mitsubishi is now part of the Renault-Nissan Alliance. I don’t know if they got any cash out of the deal, or when and if they will start sharing designs with their Renault-Nissan partners.

Or for how much longer Renault-Nissan will remain partnered.

Nissan fired Carlos Ghosn last week. Maybe they’ll find their Japanese way again.

The transition will be interesting. Kicks SE-R, anyone?

I’d say the predictions weren’t that bad in most cases when looking at the aspect of market share and whether it was heading up or down for a particular mfg combined with the fact that we are not yet to 2025.

The ones where they really got it wrong aren’t surprising because I don’t think anyone every thought the shift to the Utility vehicles and Pickups would have been so dramatic. Jeep and Ram definitely benefited from that and they fact that their cars are almost dead is now almost irrelevant. Subaru also benefited greatly from that shift.

Of course no one could have predicted the VW cheating scandal and the resulting elimination of the products their most loyal consumers were purchasing.

The interesting thing to me is what has happened to the market share in the last 10 years.

Losers

BMW

GM

Honda

Mazda

Toyota

VW

Volvo

Basically flat

Mercedes

Mitsubishi

Porsche

Winners

FCA

Ford

Hyundai

Kia

Nissan

Subaru

JLR

And of course

Tesla

The real losers of course are Saab and Suzuki.

In the end it seems there are two main forces people looking for bargains which helped Nissan, Hyundai, Kia and FCA and the shift to Utilities and trucks which benefited Ford, Subaru, FCA and JLR.

Tesla of course is a unique case as they were more or less a Boutique mfg in 2008 and they now they have an actual range of vehicles and have one in the less exclusive price range.

FCA really does stand out here, and separating RAM from Dodge was a great strategic move. I don’t see gas prices going upward anytime soon, so they should be set for the foreseeable future.

Toyota was the one that honestly surprised me. Especially given their range of SUVs and CUVs. Too many cars in the mix – and other brands offering more excitement to younger buyers, especially Nissan.

I don’t agree that separating Ram from Dodge bought FCA anything. Investing in trucks over cars is one thing — it probably saved the company. But I still scratch my head at Sergio’s mania for brand fragmentation.

Ford and Chevy badges don’t seem to hurt sales of those trucks. I suspect Dodge badges wouldn’t have harmed the appeal of FCA’s trucks.

FCA and Tesla seem to be the two biggest surprises. Nobody in 2008 predicted that FCA would have this kind of success. FCA has more market share in the US now than it did in 1962 (around 12%, IIRC). Add in Kaiser Jeep and Fiat to the figure and the conclusion probably still holds as its 1962 market share for both was negligible. Yet today the company is not far behind GM and Ford.

And only the electric faithful saw Tesla making any serious inroads.

My big missed prediction was Ford. I saw it in a position to become the dominant American manufacturer moving beyond 2008. But it still has not caught a weakened GM and a resurgent FCA is breathing on its tailgate.

For the 1962 model year, Chrysler Corporation had about 10 percent of the market, thanks to the downsizing debacle with the Plymouth and Dodge.

(The 1962 calendar year sales figures would include at least two months of the 1963 model year, when corporate sales jumped dramatically, thanks to restyled full-size Plymouths and Dodges, and all-new, more conventional and better-built Valiants and Darts.)

So FCA’s performance is even more impressive.

FCA is where it is now based on some really good but tough choices it made. Marchionne cut everything he could at the time, and I really think he was planning on more changes before his passing. I think he planned the death of at least one line of Chrysler (probably killing Dodge and rebadging whatever was left Chrysler as that is how it currently sells globally), and was going to bet the farm on Jeep with global production.

In business terms, Barra is doing what is right short term, and it probably bodes ill for the US plants not currently building crossovers or trucks. Ford is doing the same, and while painful, it is the best option under current market conditions. Basically, it means that a leaner company, shorn of overcapacity, is either stronger as it goes or more likely to be merged or purchased by a stronger company. Ford and VW seems like a possibility, based on current talks, but I cannot see a good merger/buyer for GM as it stands. Perhaps Geely would like a company that makes pickups for real people, not actors?